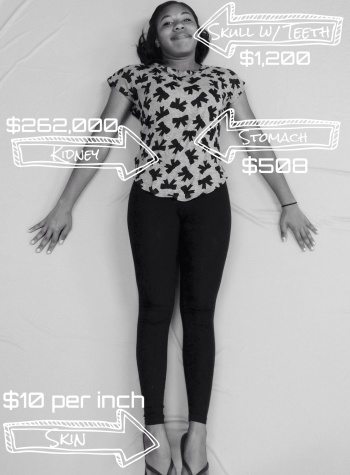

How much do kidneys sell for on the black market?

October 14, 2014

I only ask because it seems as if I’ll be auctioning my internal organs off to the highest bidder in order to acquire enough money to actually go to college.

As a senior in high school, the most pressing issue in my life is currently: what in the hell am I going to do with my life?

The obvious answer is: why, go to college, of course! Study hard and make something of yourself.

In theory, pursuing a higher education seems like a good idea. College is supposed to be one of the most stressful and exciting things I’ll ever do. It’s the final frontier, so to speak. Just the last few years (depending on my major) of education before I’m finally an independent and well-educated adult. (Let’s face it, being eighteen doesn’t make you an adult. Having a mortgage does.)

Only one thing prevents me from going to college.

A very, very, large pile of cash. More specifically, a large pile of cash that I do not have.

Currently, the total student loan debt in the U.S. is a whopping 1.2 trillion dollars. College debt is second only to mortgage, and tops even credit card debt. By the time they graduate, seven out of ten students will be thousands of dollars in debt. Even more shocking is that over the past decade, the total for student debt tripled.

College debt is a special kind of debt. If you go to college, it is almost certain you are going to get it. And if you do, it will follow you for the rest of your life. Legally, it is the most collectable kind of debt there is. It is non-dischargeable in bankruptcy, lenders can sue you in court and intercept your tax refunds if they want to. Lenders do this when a borrower’s loan becomes delinquent, or default. Having a delinquent loan simply means that you failed to pay your student loans on the scheduled time.

At the end of last year, 17% of student loans were delinquent. The delinquency continues until you, the borrower, catch up on your payments. Having a delinquent loan has a huge impact on your credit score. I seriously hope all of you know that having a credit score is a thing and how it affects your life. Welcome to adulthood, kiddos. You get out into the real world and you’re handed a mess of responsibility, among it, a credit score. (Google search “credit score,” when you’re done reading this, seriously.)

Here’s the deal: a delinquent student loan will ultimately make your credit score plummet. Having a crappy credit score makes your life harder than it needs to be. If you need to borrow money from the bank to buy a car or even a house, and your credit score is crap, your bank will be like, “Not today, man.” It may also cause you trouble when you want to sign up for utilities, or a cellphone plan.

I know most of you are probably thinking, “Dude, I can totally worry about this later.” Dude, you should totally worry about it right now. You need to at least understand the mess you’re going to get yourself into. Here’s a fun statistic for you: about 65% of student loan borrowers were surprised, or misunderstood aspects of their loans and the general borrowing process. This causes the borrower (you) to somehow screw up their payments, whether it’s with the amount of money they have to pay or when they’re supposed to pay said amount of money. So, if you want to avoid future headaches, I suggest you do your own research. Your future self will thank you, I promise.

Statistics show that the average student loan debt is rising drastically. This is because in recent years, states slashed funding for higher education by 23%. Universities responded by raising tuition for students, who in turn were forced to take out even larger loans. Loans they can’t afford.

Currently, about 30 million Americans hold student debt. The majority of student loan borrowers (about 70%) will still be paying their loans by the time they are on their 30’s, maybe even older.

Your student loan debts could even make you unemployable. Because of the large amount of debt you’ll be in, and because of how low your credit score will be as a result, potential employers may deem you as unhireable. Which is a problem. How will you be paying off those student loans without a job?

52% of graduates agreed that student debt hindered their career choices. An even larger amount reported to taking jobs that had low satisfaction but offered higher pay because of their need to pay off their student loans. This decision has a negative impact because it takes away talent from public interest fields.

Not surprisingly, the government actually profits from student loans. If the Federal Government were a private company, it would be the most profitable company on Earth. According to the Congressional Budget Office, the government made about 50 billion dollars in student loans last year alone. That is about 5 billion dollars more than Exxon Mobile, the most profitable company in the country.

My point is this: student loan debts are screwing over college students, oftentimes because they don’t understand how the loaning process actually works or they take out a loan that’s too big. The purpose of this article is to scare you into informing yourself before it’s too late.

Oh, and one more thing. Kidney’s sell for $262,000 on the black market. Just saying.

Rayshawna Collier poses as our human body on the back market.